ResMed Inc (NYSE: RMD) shares closed at $257.41, down 0.12% on the day. The inventory moved decrease following the release of the corporate’s second-quarter fiscal 2026 monetary results, which outlined quarterly efficiency, segment-level income, and up to date operational disclosures.

Market capitalization

ResMed’s market capitalization stood at roughly $37.6 billion on the finish of the Jan. 29 buying and selling session, based mostly on the corporate’s closing share worth and excellent fairness.

Newest quarterly results (Q2 FY26)

For the quarter ended Dec. 31, 2025, ResMed reported consolidated income of $1,422.8 million. Web earnings attributable to shareholders was $392.6 million. Income elevated 11% 12 months over 12 months, or 9% on a constant-currency foundation, whereas internet earnings rose 14% from the corresponding quarter a 12 months earlier.

Phase income for the quarter was reported as follows. Units income totaled $726.2 million, reflecting a 9% year-over-year enhance. Masks and different equipment generated income of $529.7 million, up 16% 12 months over 12 months. Residential Care Software program income reached $166.9 million, representing a 7% year-over-year enhance.

Monetary tendencies

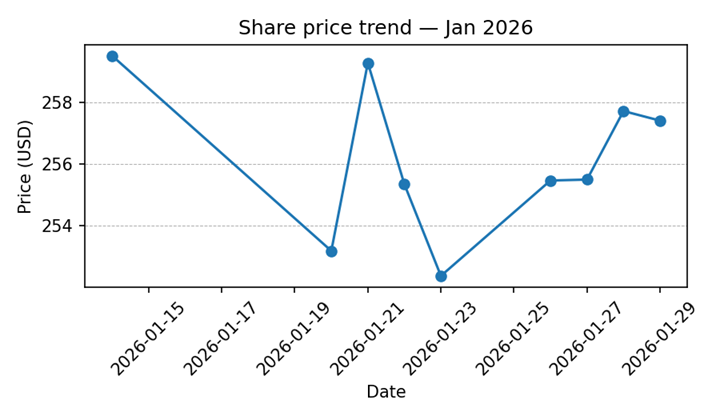

Two charts beneath summarize working efficiency and up to date share worth actions. The visuals are offered for reference and align with reported monetary disclosures.

Enterprise & operations replace

Through the quarter, ResMed reported enhancements in manufacturing effectivity, logistics execution, and element value administration. These elements contributed to a rise in gross margin in contrast with prior intervals. The corporate additionally highlighted continued enlargement of its connected-care ecosystem, with progress within the variety of cloud-connected gadgets and digital well being customers.

ResMed reported regulatory clearance in China for the AirSense 11 platform in the course of the quarter. The corporate additionally disclosed product introductions inside its masks portfolio, together with new fabric-based designs. In the USA, the corporate acquired regulatory clearance for an AI-enabled sleep apnea-related gadget, which was added to its current product lineup.

M&A or strategic strikes

ResMed reiterated that it continues to pursue selective acquisitions, primarily centered on digital well being and out-of-hospital care. The corporate referenced contributions from latest acquisitions, together with VirtuOx, in the course of the quarter. ResMed said that it usually evaluates transactions with deal sizes of as much as roughly $500 million, relying on strategic alignment and monetary standards.

The corporate additionally reported capital return exercise in the course of the quarter. Share repurchases totaled $175 million in Q2 FY26, and administration reiterated plans for greater than $600 million in repurchases throughout the total fiscal 12 months.

Fairness analyst commentary

Market individuals are anticipated to assessment the earnings name transcript, regulatory filings and subsequent analysis publications for additional institutional views.

Steerage & outlook — what to observe for

In its supplies, ResMed reiterated key monetary framework disclosures for fiscal 2026. These included non-GAAP gross margin expectations within the vary of roughly 62% to 63%, promoting, common and administrative bills of round 19% to twenty% of income, analysis and growth bills of roughly 6% to 7% of income, and a non-GAAP efficient tax price within the low‑20% vary.

The corporate additionally highlighted capital allocation priorities, together with continued funding in product growth, digital well being capabilities, and shareholder returns by means of deliberate repurchases.

Efficiency abstract

ResMed shares ended the session down 0.12%. Q2 FY26 income was reported at $1.42 billion, with internet earnings of $392.6 million. Income progress was recorded throughout gadgets, masks, and software program segments. Operational updates centered on margins, regulatory approvals, and capital return exercise.

Commercial

Source link

#ResMed #shares #slip #FY26 #results #release #AlphaStreet