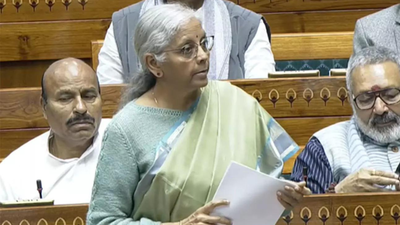

The Union Budget for FY 2026-27 has pegged total expenditure at Rs 53.47 lakh crore, Finance Minister Nirmala Sitharaman mentioned whereas replying to the dialogue on the Budget within the Lok Sabha, outlining the federal government’s technique of sustaining excessive capital spending alongside fiscal consolidation.The revised estimate for the present monetary 12 months ending March 31 has been positioned at Rs 49.64 lakh crore, decrease than the Rs 50.65 lakh crore projected in February 2025, PTI reported. The Budget dimension for FY 2024-25 stood at Rs 46.52 lakh crore.The authorities has projected tax receipts of Rs 44.04 lakh crore for FY27, a rise of about 8% over the earlier 12 months, even as general expenditure continues to stay considerably larger to help growth priorities.

File capex push and state funding help

Highlighting the federal government’s infrastructure-led growth technique, Sitharaman mentioned capital expenditure allocation has been raised to a document Rs 12.2 lakh crore.This accounts for 3.1% of GDP and is 11.5% larger than the revised estimates for FY 2025-26, she mentioned.On the advice of state finance ministers, the Centre has elevated 50-12 months curiosity-free capital expenditure loans underneath the Particular Help to States for Capital Funding (SASCI) scheme to Rs 2 lakh crore.With this, efficient capital expenditure is estimated to succeed in Rs 17.1 lakh crore, or about 4.4% of GDP, the minister added.

Fiscal deficit and borrowing roadmap

The authorities has projected fiscal deficit at 4.3% of GDP, or Rs 16.95 lakh crore, for FY27, reaffirming its fiscal consolidation path.To finance the deficit, internet market borrowings from dated securities are estimated at Rs 11.7 lakh crore. The remaining financing will come from small financial savings and different sources, whereas gross market borrowings are estimated at Rs 17.2 lakh crore.Sitharaman mentioned the federal government continues to give attention to lowering the debt-to-GDP ratio in line with the Fiscal Accountability and Budget Administration (FRBM) framework.She recalled that the federal government had indicated in Budget 2025-26 that it goals to deliver the debt-to-GDP ratio to 50±1% by FY 2030-31.In line with that roadmap, the debt-to-GDP ratio is estimated at 55.6% in Budget Estimates for FY27, in contrast with 56.1% within the revised estimates for FY26.A declining debt ratio will steadily free sources for precedence sector spending by lowering curiosity outgo, she mentioned.

Well being infrastructure and medical hub push

The finance minister mentioned states can compete to be chosen for one of 5 proposed regional medical hubs by means of PM Gati Shakti filters.States can suggest built-in hubs the place medical training and affected person remedy infrastructure shall be developed collectively, she mentioned.Devoted establishments for nursing and 10 allied well being providers shall be arrange inside these hubs to help ability creation and employment. Over time, these hubs might evolve into medical tourism centres, she added.

Fertiliser availability and farm help

Addressing considerations over fertiliser availability, Sitharaman mentioned there may be ample inventory to help farmers.The authorities has allotted Rs 1.71 lakh crore in direction of fertiliser imports to make sure continued provide and worth stability, she mentioned.

Centre-state fiscal transfers

On fund transfers to states, Sitharaman cited findings of the sixteenth Finance Fee, which analysed devolution between 2018-19 and 2022-23.“So, we’re not the one ones claiming this. The Finance Fee itself, after learning this intimately, has acknowledged in its report that the cash which has to go from the Centre to the states, taking the years 2018–19 to 2022–23 as examples and inspecting them, has clearly mentioned that no matter quantity has to go from the central authorities to the state governments has been given,” she mentioned.“There isn’t a scope for any doubt on this for the states,” she added.For FY27, the states’ share in central taxes is estimated at Rs 25.44 lakh crore, a rise of Rs 2.7 lakh crore over the earlier 12 months.She additionally mentioned cess and surcharge collections are used for improvement works throughout sectors and are separate from the 41% tax devolution advisable by the Finance Fee.

Commerce deal politics and opposition response

The finance minister additionally responded to criticism from Chief of Opposition Rahul Gandhi concerning India’s interim commerce settlement with the US.Echoing remarks made by Union Minister Kiren Rijiju, Sitharaman mentioned, “Koi mai ka laal paida nahi hua jo humare desh ko bech de ya kharid le (nobody has the audacity to promote or purchase out India).”She additional alleged that the Congress-led UPA authorities had compromised India’s place at the World Commerce Group and in addition criticised governance and regulation-and-order situations in West Bengal.West Bengal is scheduled to go to elections within the subsequent two months.

Source link

#Budget #sets #total #expenditure #lakh #crore #govt #balances #growth #fiscal #self-discipline #Sitharaman #Times #India