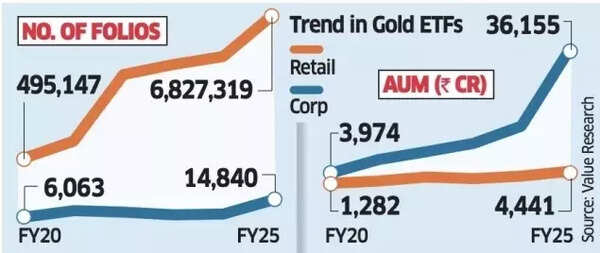

Gold has at all times discovered traction as a secure haven asset in Indian households. However, chances are you’ll be shocked to know that corporates are additionally investing in a big manner in the valuable metallic – albeit its paper model, the gold ETFs.Throughout a 5-12 months interval when gold costs elevated by 86% in greenback phrases per troy ounce, company property beneath administration (AUM) in gold ETFs skilled substantial development at 55% yearly, reaching ₹36,154.5 crore by March 2025, in response to Worth Analysis knowledge quoted in an ET report.

Why Corporates Are Betting on Gold ETFs

- Company entities, together with corporations, household places of work, trusts and organisations, have elevated their involvement in gold investments, notably as a result of unprecedented surge in gold costs over the previous 12 months.

- Corporates proportion of whole

Gold ETF AUM has risen to an unprecedented 61.4%—up from 50% in March 2020. - In distinction, particular person traders’ share in the AUM decreased considerably—falling to 7.5% in 2025 from 16.1% in 2020.

- Nonetheless, retail folios elevated by 37% 12 months-on-12 months in 2025 to roughly 6.8 million, whereas their AUM grew by 39% to ₹4,440 crore throughout a 12 months that noticed the most important worth enhance for the safe asset as a result of international institutional buying.

- Historically, company traders have favoured the cash market and liquid funds as a result of of their excessive liquidity and minimal danger profile. These liquid funds, which come with out entry or exit fees, allow simple money administration. Nonetheless, these traders are now contemplating gold ETFs to diversify their investment portfolios, appreciating the comfort of holding gold in digital type.

- “They (establishments) are now extra actively allocating to gold as half of diversified methods aimed toward managing danger and preserving capital,” mentioned Vikram Dhawan, Head of Commodities and Fund Supervisor at Nippon India Mutual Fund. “This shift displays rising institutional confidence in Gold ETFs as an environment friendly and clear car for accessing bullion publicity inside a regulated framework,” the monetary every day quoted him as saying.

Large Rise in Gold Costs

Gold costs surpassed ₹1 lakh per 10 grams in June 2025, primarily as a result of traders in search of security throughout international political unrest. By March-finish this 12 months, 24-carat gold reached ₹89,000 per 10 grams, displaying a vital enhance of almost 30% from ₹69,000 in the earlier 12 months.

Gold ETFs

The full gold ETF Property Below Administration (AUM) contains retail investments made via Fund of Fund (FoF) schemes, which are investment merchandise that put cash into different funds. These FoFs are particular mutual fund schemes that make investments in varied different schemes or merchandise.In mutual fund reporting methods, ETF investments by way of FoFs are categorised as “company” AUM moderately than retail or HNI investments. This classification happens as a result of the FoF scheme, operated by a mutual fund, holds the ETF models instantly.“The AUM figures primarily replicate company investments as a result of retail traders normally entry gold via Fund of Funds (FoFs), which in flip make investments in Gold ETFs,” mentioned Niranjan Avasthi, senior vp, Edelweiss AMC.Additionally Learn | India has the world’s seventh highest gold reserves! Why is RBI shopping for gold and the way does it assist the Indian financial system?Multi-asset funds, which are favoured by traders, additionally embody gold ETF investments in their portfolio. When an Asset Administration Firm (AMC) lacks its personal gold ETF, investments from their gold FoFs or multi-asset funds go into different AMCs’ gold ETFs. These investments seem as company AUM in the respective gold ETFs, in response to Avasthi.When AMCs with out their very own gold ETF obtain investments for their gold FoFs, they direct these funds into different corporations’ gold ETFs. Subsequently, these investments are documented as company AUM in these specific gold ETFs, as explained by Avasthi.Particular person traders have elevated their investments in gold Fund of Funds (FoFs) since July 2024, primarily as a result of advantageous tax modifications. The federal government’s price range declaration established that when gold and fairness-oriented FoFs are retained past 24 months, they might entice a lengthy-time period capital good points tax of 12.5%.

Source link

#Gold #darling #investment #Indian #households #corporates #investing #big #gold #ETFs #explained #Times #India