Creator: Indrabati Lahiri, Options Author

As local weather change and the inexperienced transition collect momentum in 2025, unlikely commodities equivalent to copper and cocoa at the moment are reshaping world financial stability the means oil as soon as did. Copper costs have surged greater than 20 % to this point this 12 months, pushed by provide crunches, inexperienced infrastructure and knowledge centre demand. Equally, cocoa has seen excessive value volatility, as a consequence of African local weather shocks, hitting report highs in early 2025, earlier than plummeting nearly 50 %.

Collectively, they spotlight a broader geopolitical shift away from fossil fuels in direction of important commodities and pure assets. With copper driving the power transition and cocoa shaping meals provide chains and moral commerce, they’ve grow to be the twin bellwethers of a altering world order.

Additionally they characterize how useful resource power and strategic property are more and more concentrated in the International South, in West Africa’s cocoa heartlands and Latin America’s copper belt. In some ways, copper and cocoa at the moment are the ‘new oil’ – strategic, scarce and consultant of each innovation and world inequality.

Underpinning the local weather transition

Copper is crucial to electrification, being utilized in electrical autos, photo voltaic panels, wind generators, hydropower vegetation, grid upgrades and extra. Demand for copper from knowledge centres, the place it’s utilized in cooling methods, inner connectivity and power methods, has elevated exponentially, supported by the surge in synthetic intelligence.

In response to the Worldwide Vitality Company (IEA), copper demand might hit 31.3 million tonnes by 2030, a substantial improve from 2021’s roughly 24.9 million tonnes. “China’s large grid enlargement and city improvement have been the single largest current driver of copper demand. Continued Chinese language industrial stimulus and infrastructure spending are due to this fact key elements underpinning copper costs,” António Alvarenga, Professor of Technique and Entrepreneurship at Nova College of Enterprise and Economics, defined. He added: “Nevertheless, copper mine output has grown solely about one to 2 % yearly, regardless of rising demand, and new initiatives take round 15–17 years to develop.”

Copper manufacturing is very concentrated in Zambia and Democratic Republic of Congo, together with Latin America’s copper belt, together with Chile and Peru. “This focus of assets is quietly reshaping world alliances, as nations compete to safe long-term entry, very like the oil geopolitics of the twentieth century,” Sunil Kansal, head of Consulting and Valuation Providers at Shasat Consulting, mentioned.

Copper and cocoa mark a shift to the commodities of the future, scarce and economically resilient

As such, any mine accidents in these key nations can have a profound affect on copper manufacturing and drive costs up. Chile’s El Teniente mine had a lethal accident again in July this 12 months, which led to a serious manufacturing halt and drop in output. This was additionally seen at the Komoa-Kakula copper mine in DRC in April as a consequence of a flooding occasion and roof collapse. Older mines and persistent underinvestment have boosted copper costs and prompted provide chain bottlenecks too currently.

“Many of the world’s main copper mines are growing older, and the common copper content material (ore grade) is declining, that means that extra rock have to be processed to extract the similar quantity of copper,” Franck Bekaert, senior rising markets analyst at Gimme Credit score, highlighted. “Moreover, allow delays and ecological constraints are hindering the launch of new initiatives, which is driving up prices. To fulfill the rising demand for copper, vital investments will probably be required,” Bekaert added.

Political instability in main producing nations, equivalent to employee strikes and environmental protests, in addition to governance points equivalent to rising corruption have additionally contributed to provide woes. At current, copper inventories are at report lows, in response to Benchmark Intelligence, at the same time as inexperienced infrastructure demand from the US and EU soars.

As the world races to affect, copper’s shortage is quick changing into a structural danger to world development, very like oil shocks as soon as have been.

How local weather shocks affect cocoa

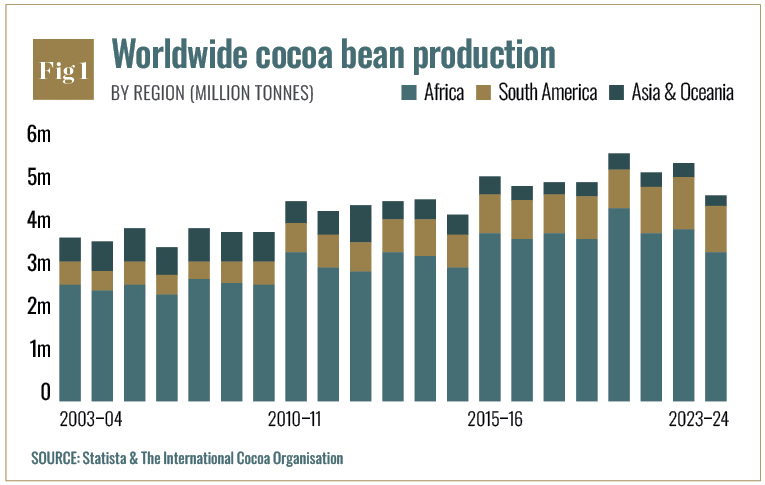

“When the Ivory Coast and Ghana sneeze, world chocolate catches a chilly. Cocoa simply had its ‘oil second’: a close to 500,000-ton world deficit in 2023–24 pushed inventories to multi-decade lows and despatched futures above $10,000/ton at the peak in January 2025,” Francisco Martin-Rayo, co-founder and CEO at Helios AI, mentioned. One of the largest causes for this was the El Niño climate sample in the 2023–24 season. This prompted risky climate patterns, equivalent to unusually heavy rain, adopted by hotter and drier climate throughout key cocoa-producing nations equivalent to Ghana and the Ivory Coast. Cocoa may be very delicate to climate adjustments because it grows solely in restricted areas of heat, humid equatorial situations, with 70 % of the crop coming from West Africa (see Fig 1). These temperature extremes prompted decreased cocoa yields and an increase in crop illnesses equivalent to swollen shoot virus and brown rot. The illnesses additionally meant that the remaining yield was of decrease high quality, additional escalating costs. Getting old West African cocoa bushes are one other issue contributing to greater costs. These can severely dampen yield capability as a result of of decreased soil fertility. Older bushes may also be extra susceptible to illnesses and pests and grow to be weaker with time.

Farmers then want to speculate giant quantities in replanting and farm rehabilitation. Nevertheless, persistently low farmer incomes make such investments troublesome to keep up, making a vicious cycle of growing older bushes, low productiveness and low incomes.

“Cocoa demand has grown steadily. Western vacation consumption and an increasing center class in Asia/Africa help baseline demand. Nevertheless, extraordinarily excessive costs can dampen consumption: in 2025 European and Asian cocoa grindings fell as producers confronted greater prices,” Alvarenga mentioned. The elements affecting cocoa transcend simply figuring out chocolate and associated product costs – they characterize a systemic disaster in agricultural provide chains as we speak, outlined by local weather volatility, worsening soil degradation and widespread farmer poverty. With a lot of the crop nonetheless tied to smallholder farmers, cocoa is a social commodity, intimately linked to human points equivalent to meals insecurity, pressured migration and earnings loss and inequality, sitting at the coronary heart of debates about moral sourcing and truthful commerce. At the same time as costs pull again barely now, the structural points driving cocoa value volatility stay.

Strategic property

Very similar to oil in previous a long time, each copper and cocoa provide has been extremely concentrated in just a few areas. This has considerably formed new geopolitical alignments and commerce tensions. One of the largest methods this has materialised is thru customers now actively in search of to diversify suppliers, to scale back provide chain and safety dangers. Copper, as a strategic metallic and asset, is now essential to nations’ decarbonisation plans. As AI and different cutting-edge applied sciences collect tempo and require extra electrical energy, copper’s standing as the ‘new oil’ is prone to continue to grow. As such, main copper customers together with the US and EU at the moment are looking for extra suppliers to unfold provide dangers.

“The US launched a piece 232 nationwide safety investigation into copper and China has pivoted away from Chile by sourcing extra from DRC, Russia and Zambia. These strikes have created new alignments – equivalent to China deepening ties with African producers, Western nations in search of various mines or stockpiles,” Alvarenga highlighted. This geopolitical strategising and positioning mimics previous useful resource wars over oil, creating new alliances between industrial powers and resource-rich nations. “As with oil, these relationships can result in commerce frictions, useful resource nationalism, and competitors for affect. For traders, this focus magnifies geopolitical danger but additionally indicators long-term strategic worth,” Edward Nikulin, climate mannequin knowledgeable at Thoughts Cash, mentioned.

For cocoa, Ghana and Ivory Coast’s governments wield appreciable provide affect by export laws and price-setting, appearing as a sort of producer bloc, much like OPEC. “We’re seeing the emergence of coordinated motion by Ghana and the Ivory Coast to demand fairer phrases, echoing the useful resource diplomacy as soon as seen in oil markets,” Kansal mentioned. That is by the ‘Dwelling Earnings Differential,’ which raises export costs to make sure that extra cocoa earnings reaches farmers immediately to enhance residing requirements and scale back youngster labour, poverty and deforestation.

“The joint $400/ton ‘Dwelling Earnings Differential’ set a de-facto flooring underneath farmgate economics, whereas EU deforestation guidelines (EUDR) are forcing farm-level traceability (GPS coordinates, plot IDs) and reshaping commerce flows towards compliant suppliers,” Martin-Rayo defined. “Count on extra native processing in Abidjan and San-Pédro and extra origin diversification to Ecuador/Brazil a traditional resource-security realignment.”

Cocoa farming is more and more utilizing extra tech equivalent to satellite tv for pc imagery, robotic pollination, floor sensors and drones. These monitor pests, development charges and soil moisture in giant plantations in actual time, serving to yields to grow to be extra secure, which may enhance cocoa’s financial and strategic significance. Equally, extra main copper corporations are specializing in accountable copper manufacturing practices, addressing sustainability and labour considerations which can be key to attracting the subsequent technology of traders. “Over the previous 5 years, copper and copper miners have considerably outpaced the S&P 500 and broad commodity indices. Devoted copper ETFs and mining shares have been well-liked. Upside for traders comes from anticipated provide deficits: pent-up demand from EVs/renewables might raise costs if new mine output lags,” Alvarenga mentioned.

Nevertheless, he emphasised that coverage intervention dangers like stockpiling and tariffs stay, which might out of the blue lower copper flows. Though cocoa is extra risky and speculative than copper, Martin-Rayo calls its oil-like standing a regime shift. “Assume of cocoa as smaller than oil, however newly ‘systemic’ for meals producers and retailers.”

The street forward

2025 highlights the begin of a ‘post-oil’ useful resource period – one the place sustainable and moral commodities maintain power. The ‘new oil’ could also be mined, grown or digitally verifiable, as an alternative of liquid. Each copper and cocoa mark a shift to the commodities of the future, scarce and economically resilient in an more and more fragmented world, with traders demanding steadiness between transparency, accountability and development.

Source link

#Copper #cocoa #geography #power