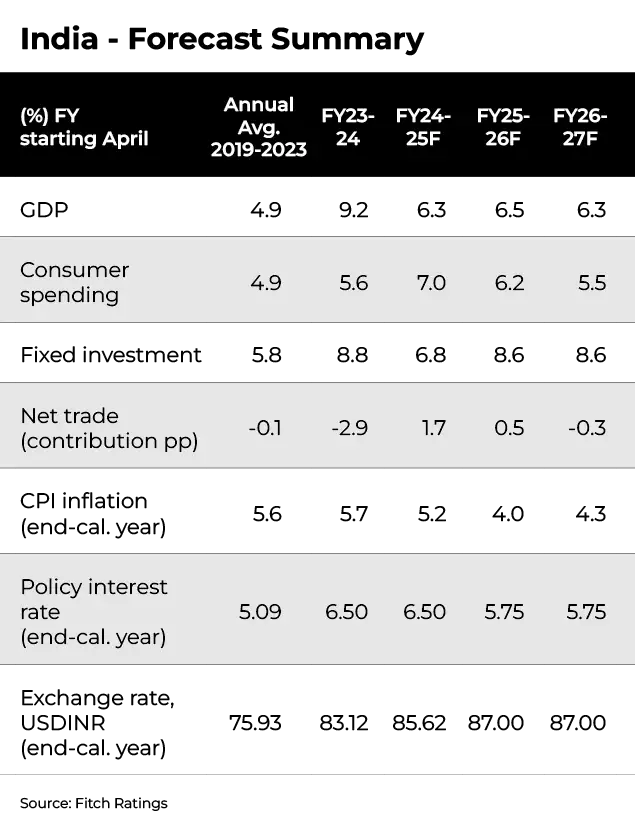

New Delhi: India’s low reliance on exterior demand is predicted to protect the nation from US commerce insurance policies, Fitch Rankings mentioned Wednesday. Whereas India’s financial development forecast for FY26 is unchanged at 6.5% from the December outlook, the projection for FY27 was revised upwards by 10 foundation factors to six.3%.

This fiscal yr, India’s gross home product (GDP) is anticipated to develop by 6.3%, the worldwide ranking company mentioned.

Client spending will decide up tempo within the coming two fiscal years, albeit at a slower tempo, it famous.

The Indian financial system gained momentum within the December quarter, increasing 6.2% from a seven-quarter low of 5.6% within the quarter earlier than, led by improved client spending and better authorities expenditure.

The scores company forecasts development of seven.1% within the fourth quarter FY25 and 6.8% within the first quarter of FY26.

“Enterprise confidence stays excessive and lending surveys level to continued double-digit development in financial institution lending to the personal sector,” Fitch mentioned in its World Financial Outlook.

It additionally expects a pickup in capital spending in FY26 and FY27.

Inflation on Wane

World GDP development is predicted to gradual to 2.3% in 2025 and a couple of.2% in 2026, from 2.9% in 2024, in line with Fitch. GDP development within the US will gradual to 1.7% in 2025 and 1.5% in 2026, following 2.8% development in 2024.

Inflation in India is projected to say no to 4% by the top of December on account of falling meals costs. Nonetheless, Fitch expects a light enhance to 4.3% by December 2026.

Additional, the company anticipates two extra price cuts in 2025, resulting in a coverage price of 5.75% by December.

In February, the Reserve Financial institution of India (RBI) Financial Coverage Committee (MPC) lowered the coverage price by 25 foundation factors to six.25%, marking the primary lower in 5 years. The MPC meets subsequent on April 7-9.

Whereas client confidence has waned barely in latest months, decrease inflation, regular employment development, and tax revisions introduced within the finances are anticipated to assist client spending development subsequent fiscal, although at a slower tempo than this yr, Fitch famous.

Client spending is forecast to develop by 6.2% in FY26 in comparison with 7% in FY25. Progress will additional gradual to five.5% in FY27.

Source link

#Fitch #Retains #Indias #GDP #Forecast #FY26 #ETCFO