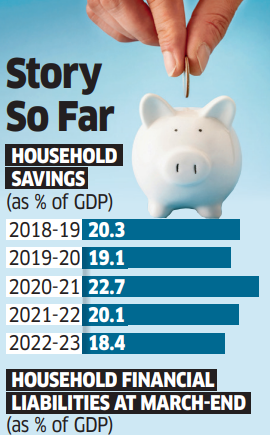

New Delhi: The finance ministry knowledgeable the Parliament {that a} shift in family deposits from banks to market-linked financial merchandise looking for larger returns could expose the households to vital market dangers and that they might face financial losses throughout market corrections or volatility due to insufficient evaluation of dangers and financial literacy.

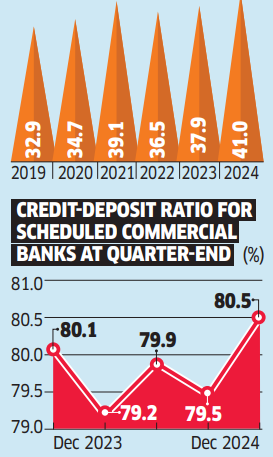

The Division of Financial Companies, beneath the finance ministry, stated in a written submission to the parliamentary standing committee on demand for grants that the “decline in financial savings poses challenges for the banking sector when it comes to sustaining liquidity”, including that withdrawal of family savings from banks would disrupt banks’ entry to low-cost supply of funds, which might lead to an increase in the price of funds for banks.

Key Solutions

The committee, in its suggestions in a report tabled in Parliament on Wednesday, known as for proactively addressing liquidity considerations, enhancing buyer attraction, particularly in underserved areas, and leveraging expertise for operational effectivity in order that banks can mitigate the influence of declining CASA (present account savings account) ratios.

FDI in insurance coverage

On the problem of the budgetary announcement of 100% international direct funding (FDI) within the insurance coverage sector, the committee underscored the necessity for some safeguard measures to be in place to counter considerations similar to revenue repatriation, which refers to international buyers sending earnings again to dwelling nations reasonably than reinvesting in India, diminished choice-making energy of home corporations and job safety considerations arising from potential automation and price-slicing measures.

Whereas highlighting different points such because the concentrate on excessive-margin insurance policies and neglecting rural and financially weaker sections, the committee really helpful that the draw back of FDI in India’s insurance coverage sector be handled “adequately and scrupulously”.

Grievance redressal

Whereas noting that the variety of complaints acquired beneath the Reserve Financial institution of India’s Built-in Ombudsman Scheme had elevated at a compounded common progress charge of just about 50% over the previous two years to about 934,000 in 2023-24, the committee stated mechanisms must be put in place for decision of grievances spanning a number of sectors.

Jan Dhan accounts

The committee made a case for making certain that accounts opened beneath the scheme are energetic and never dormant or fraudulent and really helpful rigorous verification of account particulars and common audits of account exercise.

“Discrepancies must be completely investigated and accounts which might be inactive for extended intervals or discovered to be fraudulent must be deactivated,” it stated.

Source link

#Household #savings #flow #financial #market #pose #dangers #finance #ministry #ETCFO