Regardless of a succession of shocks since 2020, the global economic system has held up remarkably properly – thus far. However the margin for error is dwindling. Whole global debt is now practically 25 % larger than it was on the eve of the Covid-19 pandemic, when it already was at an all-time excessive. This overhang may undercut all economies’ skill to protect themselves in opposition to the newest shock: larger commerce tariffs.

Though debt is essential for driving financial progress, it needs to be understood as a type of deferred taxation. By borrowing fairly than taxing, governments could make long-term investments that may profit future taxpayers with out burdening the present era; or they will prop up nationwide progress and incomes throughout an financial emergency, when climbing taxes would solely deepen the downturn. Ultimately, nonetheless, the piper have to be paid, and if nationwide earnings doesn’t develop quicker than the price of borrowing, taxes have to be raised to repay the debt. Persistently excessive debt thus turns into a barrier to financial progress. That barrier has seldom been larger. During the last 15 years, creating international locations obtained hooked on debt, which they amassed at a record-setting clip: six share factors of GDP per yr, on common. Such fast debt buildups usually finish in tears. Certainly, the percentages that they may set off a monetary disaster are roughly 50-50.

Furthermore, this specific surge has been punctuated by the quickest enhance in rates of interest in 4 many years. Borrowing prices doubled for half of all creating economies, with internet curiosity prices as a share of presidency revenues rising from lower than 9 % in 2007 to about 20 % in 2024. That alone constitutes a disaster. Though the world has thus far managed to dodge a ‘systemic’ monetary meltdown of the 2008–09 selection, too many creating economies at the moment are in a doom loop. To service their money owed, many are slicing the investments in training, well being care and infrastructure that they should guarantee future progress.

Future global workforce

That is very true of the 78 poor international locations which might be eligible to borrow from the World Financial institution’s Worldwide Improvement Affiliation. These international locations are dwelling to one-quarter of humanity, representing a big slice of the 1.2 billion younger individuals who will enter the global workforce within the subsequent 10–15 years. But policymakers world wide have opted to tempt destiny. In one other triumph of hope over expertise, they’re betting that global progress will speed up – and that rates of interest will fall – by simply sufficient to defuse the debt bomb.

The world can’t afford yet one more decade of drift and denial the place debt is anxious

Such passivity is comprehensible. It has been extraordinarily tough to plan a Twenty first-century system able to guaranteeing global debt sustainability and swift debt restructuring for international locations that want it. Within the absence of such a system, the progress that has occurred has been too sluggish to keep away from rising debt risks. However the world can’t afford yet one more decade of drift and denial the place debt is anxious.

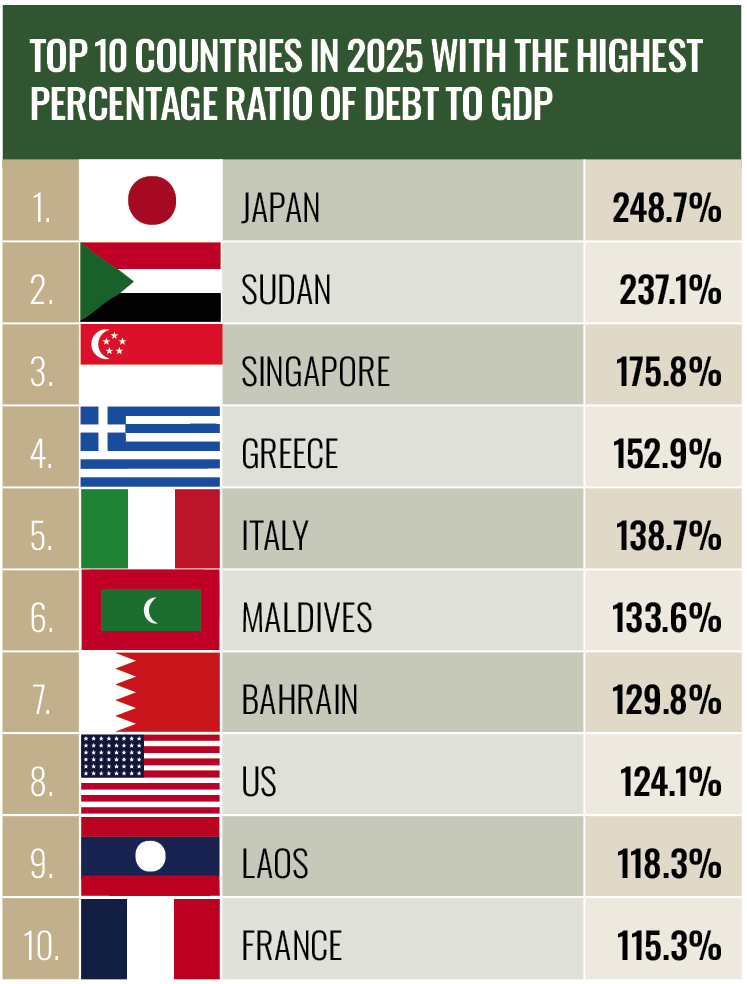

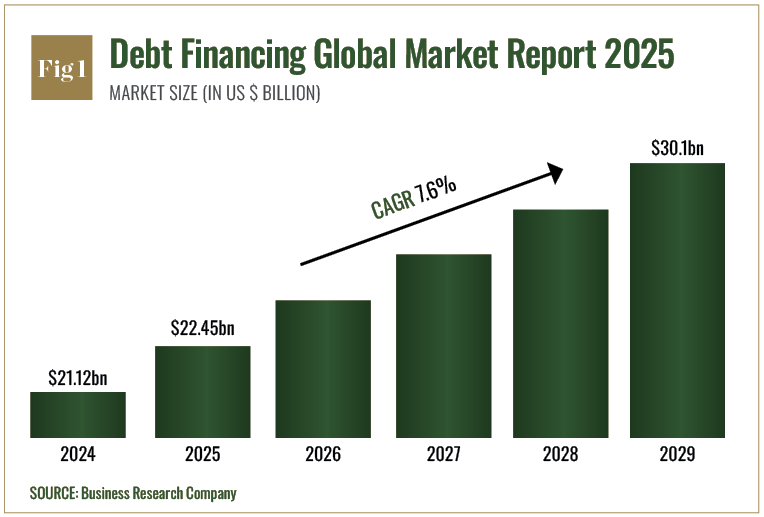

Underneath present insurance policies, global progress won’t velocity up anytime quickly, which implies that sovereign debt-to-GDP ratios are prone to climb for the rest of this decade (see Fig 1).

Gloomy forecast predicted

At the moment’s commerce wars and record-breaking ranges of coverage uncertainty have solely made the outlook worse. Firstly of 2025, the consensus forecast amongst economists was predicted 2.6 % global progress this yr. That quantity is now right down to 2.2 % – practically a 3rd decrease than the typical that prevailed within the 2010s. Nor will rates of interest fall. In superior economies, rates of interest set by central banks are anticipated to common 3.4 % this yr and subsequent, greater than 5 occasions the annual common between 2010 and 2019. It will compound creating economies’ difficulties. In an period of scarce public assets, it would take an all-out mobilisation of personal capital to spice up progress and improvement over the subsequent 5 years. However overseas personal capital is unlikely to circulate into extremely indebted economies with weak progress prospects.

Non-public buyers will appropriately assume that any beneficial properties from financial progress will merely be taxed to repay the debt. Thus, decreasing debt needs to be the highest precedence for creating economies with persistently excessive debt-to-GDP ratios. However we additionally want a clear-eyed view of the broader drawback: the global equipment for assessing the sustainability of a rustic’s debt urgently must be upgraded. The present system is simply too fast to resolve that international locations merely want loans to tide them over, when most low-income international locations as we speak are actually bancrupt and can want debt write-offs. Governments additionally might want to ditch the behavior of borrowing from home collectors; the rise in home debt is strangling home private-sector initiative.

The tariffs subject

After decreasing debt, the subsequent precedence is to speed up progress. It’s silly to fake that progress will magically return. Insurance policies that impede commerce and funding – like tariffs and non-tariff boundaries – needs to be rolled again as quickly and as a lot as doable. For a lot of creating economies, slicing tariffs equally with respect to all buying and selling companions might be the quickest method to restore progress. Growing economies even have a lot to realize by fostering a extra investment-friendly regulatory surroundings. And people beneficial properties can be utilized to shift the nationwide focus again to improvement, significantly by ratcheting up investments in well being, training, and infrastructure.

The present system is simply too fast to resolve that international locations merely want loans to tide them over

Because the saying goes, if you find yourself in a gap, it’s smart to cease digging. An period of terribly low rates of interest inspired too many international locations to spend far past their means. A string of catastrophes – each pure and man-made – made it unimaginable for them to do the rest within the final 5 years. However prudence is now important. Governments ought to revert to earlier norms on what constitutes extreme sovereign debt. Name it the 40-60 most: 40 % of GDP for low-income economies, 60 % for high-income economies, with everybody else in between.

Source link

#looming #global #debt #disaster