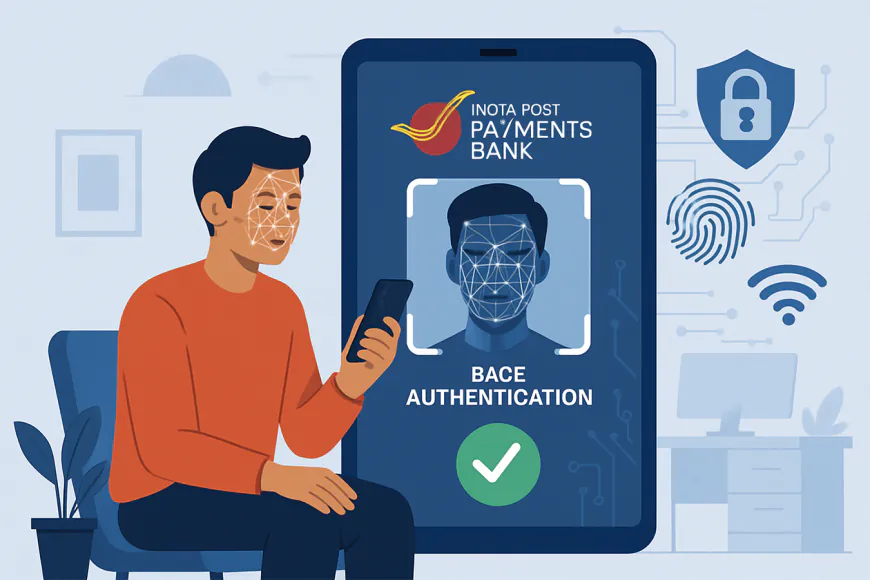

In a serious step towards inclusive and accessible digital banking, India Publish Funds Financial institution (IPPB) has launched its Aadhaar-based Face Authentication characteristic throughout the nation. Introduced on August 1, 2025, the initiative is designed to empower prospects — particularly the aged, differently-abled, and people with worn fingerprints — by providing a seamless, safe, and contactless strategy to perform monetary transactions.

This modern authentication system leverages facial recognition know-how developed below the Distinctive Identification Authority of India (UIDAI) framework. With this characteristic, prospects now not must depend on conventional biometric strategies like fingerprints and even OTPs. As an alternative, they will full transactions utilizing simply their face — making digital banking each simpler and extra dignified.

Banking with Dignity for All

Shri R Viswesvaran, MD & CEO of IPPB, emphasised the human impression of the rollout. “At IPPB, we consider that banking shouldn’t simply be accessible, however dignified too. With Aadhaar-based face authentication, we’re guaranteeing that no buyer is left behind as a result of limitations in biometric fingerprints or OTP verification. It’s not only a tech characteristic; it’s a step in the direction of redefining monetary inclusion at scale,” he stated.

Key Advantages of the Face Authentication Function

-

Inclusivity First: Designed to profit senior residents, differently-abled people, and other people with worn fingerprints.

-

Enhanced Safety: Aadhaar verification is completed with out counting on OTPs or fingerprint sensors.

-

Contactless Expertise: Permits quick, easy, and hygienic banking — particularly helpful throughout well being emergencies.

-

Complete Entry: Helps all core banking companies — from opening accounts and checking balances to transferring funds and paying utility payments.

Supporting India’s Digital and Monetary Inclusion Objectives

The nationwide implementation of this know-how instantly aligns with the Authorities of India’s flagship missions — Digital India and Monetary Inclusion. It demonstrates how cutting-edge know-how could be harnessed not simply for comfort but additionally for selling fairness, entry, and empowerment throughout the nation.

Source link

#IPPB #Launches #Aadhaar #Face #Authentication #Inclusive #Banking