Ardelyx Inc. (NASDAQ: ARDX). ARDX Q4 2025 earnings delivered distinctive outcomes. IBSRELA income surged 73% yearly. Complete firm revenues reached $407.3 million. Certainly, the biotech firm exceeded expectations with disciplined execution and expanded product adoption. In the meantime, administration supplied assured 2026 steerage.

IBSRELA and XPHOZAH Product Efficiency

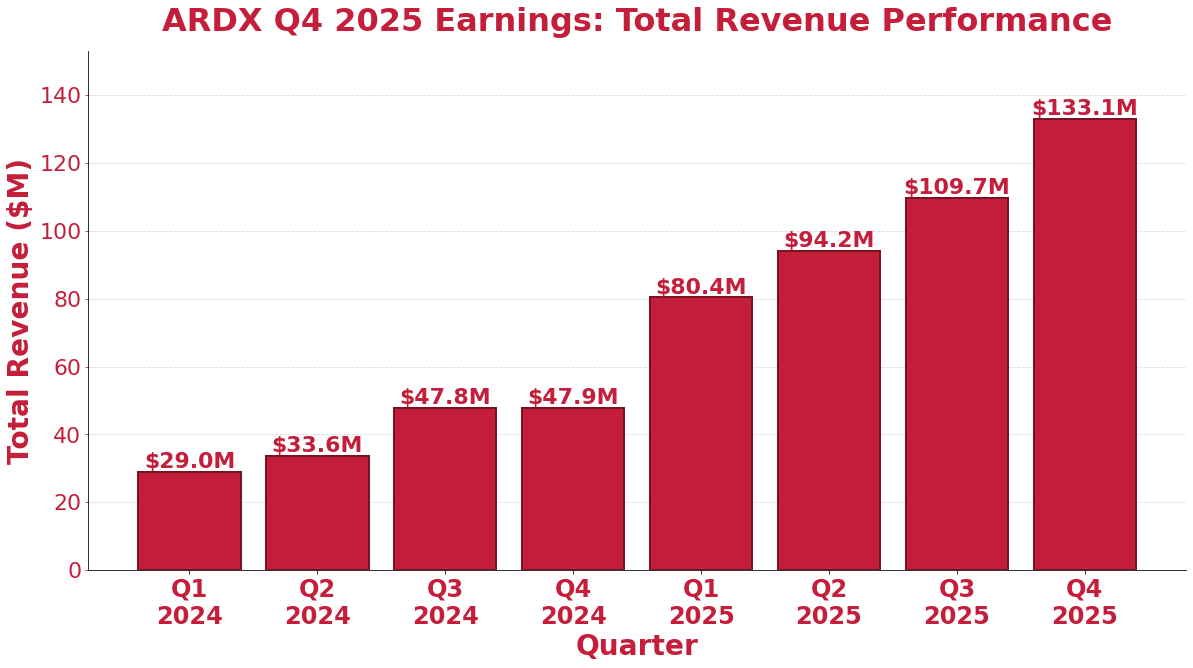

So, IBSRELA dominated 2025 with $274.2 million in income. This displays 73% development versus 2024. Q4 2025 IBSRELA income hit $86.6 million. Plus, this represented 61% year-over-year development. In the meantime, XPHOZAH contributed $103.6 million for the complete 12 months. Certainly, Q4 XPHOZAH income was $27.8 million. Notably, whole firm revenues reached $407.3 million in 2025.

ARDX Q4 2025 Earnings: Monetary Outcomes

Not too long ago, full 12 months 2025 web loss was $61.6 million. This compares favorably with prior 12 months efficiency. Industrial execution improved considerably. So, IBSRELA prescribing depth and breadth expanded. Additionally, affected person engagement with IBS-C inhabitants strengthened. Moreover, prescription pull-through metrics improved considerably. In actual fact, the corporate maintained operational self-discipline all through 2025.

ARDX Q4 2025 : Key Growth Drivers

IBSRELA adoption accelerated amongst goal healthcare suppliers. So, elevated prescriber engagement drove utilization features. Plus, patient-first XPHOZAH technique expanded entry. Then, non-Medicare affected person populations grew. In the meantime, growth applications for brand spanking new IBSRELA indication launched. Certainly, next-generation NHE3 inhibitor applications superior quickly. In consequence, the corporate constructed important momentum coming into 2026.

2026 Steerage and Strategic Outlook

Administration expects continued momentum in 2026. So, IBSRELA income steerage ranges from $410 million to $430 million. This suggests at the very least 50% development versus 2025. Plus, the corporate targets IBSRELA reaching $1 billion in annual income by 2029. In the meantime, growth applications for brand spanking new indications progress. Importantly, the corporate stays effectively capitalized for present goals. Certainly, long-term technique focuses on delivering novel therapies to sufferers with unmet wants.

ARDX Q4 2025 earnings whole firm income demonstrates growth of product portfolio past IBSRELA.

ARDX Q4 2025 : Key Takeaways

- IBSRELA 2025 income: $274.2 million (73% development)

- Q4 IBSRELA income: $86.6 million (61% YoY development)

- Complete 2025 revenues: $407.3 million

- 2026 IBSRELA steerage: $410-430 million (50%+ development)

For particulars, see the Ardelyx Q4 2025 earnings press launch. Additionally go to Yahoo Finance or NASDAQ.

Click on Right here to go to the AlphaStreet web site.

Source link

#ARDX #Earnings #Explode #Biotech #Growth #Breakthrough