Sandisk Company (NASDAQ: SNDK) issued an optimistic outlook for the fiscal third quarter of 2026, projecting income between $4.4 billion and $4.8 billion. The corporate anticipates non-GAAP earnings per share to vary from $12.00 to $14.00, citing sustained momentum in knowledge middle demand. Traders are monitoring the continued adoption of NAND flash in knowledge middle environments and the stabilization of world reminiscence pricing.

Sandisk shares rose by 12.00 % in intraday buying and selling following the discharge of the corporate’s fiscal second quarter monetary outcomes. The inventory motion displays investor response to the earnings report issued on January 29, 2026. The market capitalization of Sandisk Company stands at roughly $79.04 billion as of immediately’s market session.

Newest Quarterly Results

Sandisk Company reported consolidated income of $3.025 billion for the fiscal second quarter ended December 2025. This determine represents a 61 % enhance in comparison with the $1.876 billion reported in the identical interval of the earlier yr. Consolidated internet revenue for the quarter was $803 million, reflecting progress from the prior yr’s outcomes.

Phase efficiency:

- Datacenter: Income reached $440 million, a rise of 76 % year-over-year.

- Edge: Income totaled $1.678 billion, representing 63 % progress in comparison with the earlier yr.

- Shopper: Income stood at $907 million, up 52 % year-over-year.

Monetary Traits

The next charts illustrate the corporate’s working and market efficiency.

Working Efficiency

Quarterly income development for the final three reporting intervals.

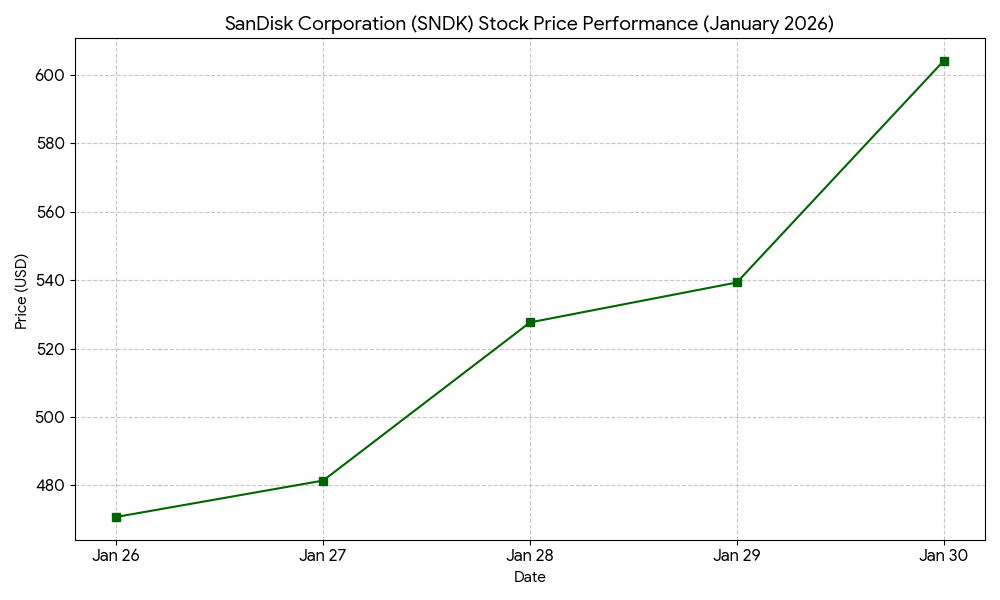

Market Efficiency

SNDK inventory value motion over the 5 buying and selling days resulting in the present session.

Full 12 months Results Context

For the complete fiscal yr 2025, Sandisk reported whole income of $7.355 billion. This marked a directional development of progress in comparison with fiscal 2024. Nonetheless, the corporate reported a GAAP internet lack of $1.641 billion for the complete yr, indicating a contraction in annual profitability relative to the earlier reporting cycle.

Enterprise & Operations Replace

Sandisk accomplished its formal separation from Western Digital in February 2025, working now as an impartial entity. The corporate reported the continued ramp of its BiCS8 flash reminiscence know-how. Operational focus stays on scaling manufacturing capability to satisfy demand for synthetic intelligence infrastructure.

M&A or Strategic Strikes

The corporate introduced an extension of its three way partnership with Kioxia Company. The settlement secures the partnership via 2034, masking joint growth and manufacturing on the Yokkaichi and Kitakami websites in Japan. No different main transactions have been disclosed throughout this reporting interval.

Efficiency Abstract

Sandisk inventory moved greater by 12.00 % following the quarterly replace. The corporate reported $3.025 billion in income and $803 million in internet revenue. Progress was noticed throughout the Datacenter, Edge, and Shopper segments. The fiscal second quarter outcomes point out an upward development in quarterly income and section efficiency.

Commercial

Source link

#Sandisk #Lifts #Guidance #Strong #Results #AlphaStreet